Before the Brief: How to do desk research

With a brief explanation of why you absolutely should

I had such a good time explaining how to do observational research, that I thought I’d also take a moment to explain how to do secondary (a.k.a., “desk”) research.

In my view, you can’t even begin to frame or reframe the problem to be solved until you’ve done both of these things.

In my view, you shouldn’t turn up to a big client meeting without having done both of these things.

In my view, you’re nowhere near being ready to start writing up a creative brief, or designing primary research (qualitative or quantitative), or developing “How might we?” questions, or prototyping … until you’ve done both of these things.

A note about strategic naïveté and the idea of the novice

It’s just true that consultants and agents are rarely in a position to be experts on their clients’ businesses and industry sectors. Especially in marketing, we’re not often engaged in on-going, full-time, immersive relationships with our clients — our relationships are assignment-based, even in an AOR contract.

It’s also just true that consultancies and agencies should be experts in what they do — analysis or strategy development, making advertising, etc.

But clients do still feel that this latter expertise is less valuable without more of the former. And so it has come to pass that we agency strategists and market researchers and brand consultants console ourselves with the idea that there is something virtuous about being a novice.

And there is! Being a novice means that you are not locked into The Way It’s Been Done. It means you are new to something. It means you have some level of naïveté, which allows you to question, side-step, ignore, not even see traditions and habits that may be holding back the experts.

But being a novice, being naïve, is not the same as being ignorant.

Showing up at a client meeting, or a stakeholder interview, or a briefing session having done absolutely no homework is not a good look.

Deciding that you don’t need to know more than what the client told you in order to do your job is a pretty good way to undermine any trust the client had in you or your firm, and to ensure that you never progress beyond naïveté.

Here’s another thing about novices. They take learning about this new thing very, very seriously. If you’re not ready to commit yourself to learning as much as you can about the client, their sector, their problem, then you’re not a novice. You’re just someone who doesn’t want to do the homework.

Now — if you’ve come to believe that expertise is the same as being locked into the old ways of doing things, and you work in an agency or consultancy, let me offer you this solace: your world is assignment/project-based. Your clients will come and go. Your engagements last somewhere from 6 weeks to a year. You will move on to another client, another assignment, another category. You are in very little danger of becoming an expert.

But that doesn’t mean you shouldn’t try.

Why desk research matters

You have a new assignment, a new client, in a new sector. You know very little, only what the client has told you thus far, which wasn’t much. You need to talk to stakeholders, host a client workshop, prepare for a pitch, attend a client briefing. It would be good to be able to ask smart questions that could lead the client to provide some guidance or direction, or to reveal their preferences, or to help you get to the real heart of their problem (their problem is almost never that they don’t have enough ads or data; they want help solving a business problem — but they don’t always know how to talk about it with outsiders).

So, you prepare. It’s just like college — generally it is better to have done the reading before you attend the lecture, so you know what the hell the professor is talking about.

Asking smart questions also helps to build your client’s confidence in you. They will receive the signal that you have done your homework, that you are invested in helping solve the problem, that you will ask insightful and incisive questions, that you will be able to engage them as thought partners, or even equals.

But it’s day one of an assignment, and you don’t know anything yet. It feels daunting — where to begin?

I have excellent news. The category, the client, their brand was not invented on the day you first met. You are not the only person to have ever thought about these things. Other people have left a paper trail for you to follow. Your job is to find that trail, and then, well, follow it.

Following the paper trail

A lot of information you want or need already exists, is readily accessible on the internet, and is …. FREE.

About the company

Let’s start with the basics.

Annual Reports

A lot of us work with clients whose companies are publicly traded; are privately held but still have to file disclosures with the SEC because they have more than 500 shareholders and $10million in assets; or are preparing to go public. At a minimum, these kinds of companies must file a Form 10 (publicly traded or privately held companies as above) or a Form S-1 (companies preparing to go public). Conveniently, these forms are publicly available. To search for these filings — going back many years, by the way — you can use the Edgar search engine, hosted by the SEC.

Annual reports often accompany Form 10 filings. You can often find these on the company’s corporate website. A good place to look is in the footer of their website, usually with a link like “Investor Relations”.

Annual Reports and 10-Ks provide a great deal of information about the company’s position in the marketplace, it’s financial health, where it sees threats and opportunities arising, and what it is investing in.

If you were thinking about asking the client how they see their market position, or going through a SWOT analysis with you in a stakeholder interview, or just asking where they think growth will come from — you can get a lot of those questions answered by reading an annual report.

The Org Chart

Oftentimes, we don’t know who our client directly reports to, and even if we do, it’s hard to know who their bosses report to, and so on. What’s the chain of influence up to the top of the company? How do different people on the email cc: list relate to one another. You can — and should! — ask your clients for guidance on that.

But you can also find out on your own. Large companies tend to make announcements about recent hires or promotions. Go back to that corporate website footer, and you might find a “press releases”, or “about us” link. Scroll through the headlines, and you’ll inevitably find announcements of new senior hires, retirements, promotions, and so on. If you want to know about the marketing team, you’ll also find that AdAge and Adweek will do write-ups on people moving from agencies to clients, between clients, between agencies. A google search is enough to find out who the company wants the public (read: shareholders and competitors) to know.

You have another tool at your disposal: LinkedIn. It’s helpful to know some key facts about your client partners and their internal teams and bosses.

- How long have they been with the company?

- How long have they been in this role?

- Where were they before?

- What is their area of interest or expertise?

It’s also worth a look to see if these people have public-facing twitter accounts, have written anything publicly for trade or business journals, have been quoted in news reports about the brand or the sector, or have given speeches at conferences or other events that you can watch.

What is being said about the company, and what is being said by the company?

This is stuff I hope you’re all doing, but here we go. Do a search for recent news articles or commentary about the company in the relevant trade or business press. I always look for links from sources like the business pages of major newspapers, or business-focused papers like the WSJ and the Financial Times. If you want to know what investors care about, Barron’s is a good source. If you want to know what their peers are saying, try the trade press (e.g., The Business of Fashion or Aviation Week).

As ever, you should study their website and landing pages, their social accounts, and social media mentions. But you should also try to get your hands on their current (and historical) advertising, and brand ID. Good sources here are YouTube, Adland, and Google Image searches.

What is it like to work there?

Have they redesigned their offices? Have articles been written about a new building or campus? How are they doing according to employees? What is their Glassdoor rating?

About the Competition

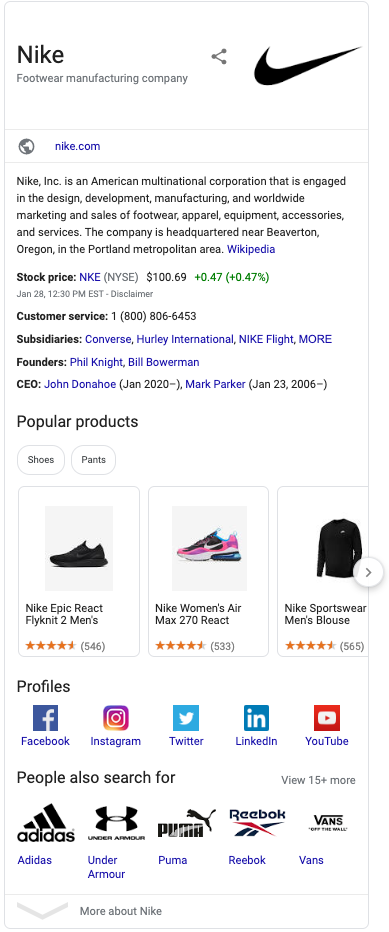

First of all, how do you figure out who the competition are? Well, the client might have mentioned that in your briefing documents, or in their Annual Reports. But there’s another way to get some clues. And it’s right there on the right-hand side of the screen in a google search.

Look at how much information is here. The stock price and ticker symbol! Subsidiaries! The names of founders and CEOs! Links to their social accounts! And then… “People also search for” — a list of competitor brands, right there.

Now you take those steps we did above for the client brand, and we repeat for the most important competitors. How do you decide who is important? Well, your mileage may vary, but I try to look at those who are operating in the same markets, offering similar goods or services, comparable in company size and market cap, or otherwise similarly situated. Then I look for a couple of much smaller, niche or up-and-coming players who are getting a lot of recent attention, or any company that is described as a “challenger” to the client’s brand.

So it turns out that there are people in the world who just spend their time analyzing market sectors and publishing reports to the internet for public consumption. They are called “analysts” and they work at places like Deloitte, PwC, McKinsey, Merrill Lynch or Goldman Sachs. Their analysts produce reports and outlooks on different market sectors. Some of them even produce podcasts. Scroll through their feeds to find discussions about your client’s sector.

Venture Capitalists are also in on the action — Sequoia, Andreessen Horowitz, Union Square Ventures all have blogs, newsletters or podcasts.

I like the content on Scott Galloway’s Section4.com, and his No Mercy/No Malice newsletter. CBInsights also has a pretty smart newsletter if your client is in the tech space.

If your client’s business operates in meatspace — retail outlets or other commercial real estate — a great source is CBRE.com, though their analysis is written from the point of view of investors specifically in real estate. Nevertheless, they have some great insight into manufacturing, retail, hospitality, and so on.

And another favorite of planners should be eMarketer. They post topline reports for free (full reports are expensive), and offer a lot of the marketing charts for free as well.

Now, here’s my last bit of advice here: the use of Google Alerts. You should set them up for your client, and for the competitors you identified. Get them sent to your email in a daily digest. Keep ’em coming for the life of your engagement. And if you’re like me, just… keep ’em coming.

High-end desk research

Maybe you are lucky/prosperous. Maybe you have a budget for desk research. Then by all means, subscribe to Nielsen, Gartner/L2, Forrester, CBInsights; buy reports from eMarketer, Mintel or Euromonitor. But I don’t have a budget like that — so I rely on other sources.

Of course, a time honored tradition among planners is to ask their friends at bigger and richer agencies to pull a couple of key reports for them (or just, use their logins!), and if you have that kind of connect, well, I leave that to your good judgment.

Sense-making & pattern recognition

What you do next is incredibly important. You need to compare and contrast what you know about your client’s brand and business, with what you know about their competitors, and the sector overall.

Look for patterns. Look for outliers. Constantly ask why things are the way they are, or why a company is making that investment or selling that division. Try to aim a critical eye at the aesthetic judgements of the brand, and the voice that it uses in public communication. What do they want people to think, feel and do about them?

You may never make a formal presentation to anyone about all that you’ve learned, but your analysis and synthesis of the data you gather will put you in a position to ask better questions when you meet with clients, interview stakeholders, or design research with customers.

One last note on storage and sharing

Keep everything. Share what you learn with your team.

- Store the PDFs, audio or video (where possible) of articles and presentations and reports where your team can access them.

- Keep a bibliography of your sources, with links (especially for video or audio). Pick a style, MLA or Chicago, for assembling a bibliography. Links alone are not enough! Titles, authors, dates. That’s how information is found again.

- Keep the bibliography organized — by topic, theme, brand, whatever helps you keep track of the information you collected.

- Some people write a sentence or two summarizing what was useful in the article — even though this strikes me as incredibly good practice, I confess I don’t always do it.

- I definitely copy and paste or transcribe any key quotations I want to use in presentations.

- Write a memo to your colleagues summarizing the main findings of this research. You’ll have gone deeper on this desk research, but it’s still critically important the whole team is playing from the same starting point.

There you go. This is how I do desk research. I hope it’s useful for you. Would love to hear what sources you love, or what tools you find useful.